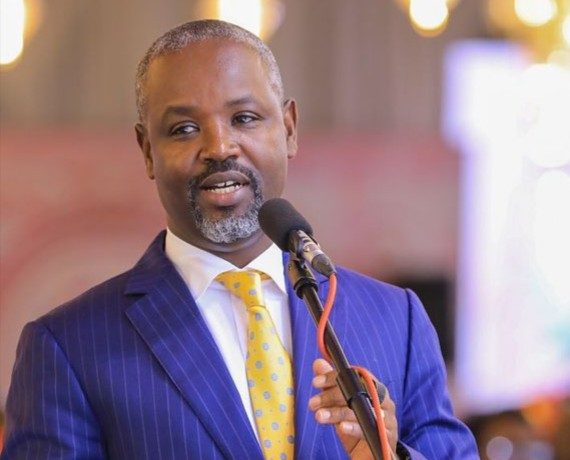

Kampala, Uganda – Uganda’s Deputy Speaker Thomas Tayebwa has taken to social media platform X to express his concern over the disturbing practices of online money lending app, Mangu Cash.

Tayebwa shared his personal experience, receiving a call from a representative of the app, threatening to deduct loan money if he didn’t produce a random person who had used his name as a next of kin while borrowing.

“Whoever is regulating these online lenders should crack the whip on them. I have just received a call from some tough-speaking lady claiming to be from Mangu Cash threatening to deduct their loan money if I don’t produce some random person who put my name as their next of kin when they were borrowing.” Tayebwa wrote on his X handle

He added, “I hope our telecoms do not allow their mobile money platforms to be used to carry out fraud orchestrated by such unscrupulous companies. @Tom_Magambo you need to interest your self in this sector many Ugandans might be dying quietly.”

This incident has sparked outrage, with many Ugandans coming forward to share similar experiences with online lending platforms. The main concerns revolve around:

Exorbitant Interest Rates: Users have reported extremely high interest rates, making it difficult to repay loans.

Lack of Transparency: Loan terms and conditions are often unclear, leading to misunderstandings.

Aggressive Debt Collection: Borrowers have reported harassment and intimidation by debt collectors.

Privacy Breaches: Lending platforms collect sensitive information, including location, messages, social media, call logs, and contacts.

Honorable Semujju Nganda retweeted Tayebwa’s post, echoing the concerns and calling for action against these unscrupulous companies.

“My boss, @mtnug @ @Airtel_Ug may be promoting these probably by selling people’s data to these criminals. Because, how do these criminals get access to bunches of people’s number and start sending customized messages?” Honourable Semujju Nganda responded to speaker Tayebwa on his X formerly twitter

Tayebwa’s warning highlights the need for regulation and oversight in the online lending industry to protect consumers from exploitation.

As a seasoned politician and lawyer, Tayebwa’s voice carries significant weight. His concern comes at a time when online lending platforms, such as Mara, Mangu Cash, and Kasente, have proliferated across Uganda, capitalizing on the country’s growing mobile smartphone penetration and increasing need for short-term financial solutions.

The Uganda Microfinance Regulatory Authority (UMRA) has issued guidelines to regulate digital lending and protect consumers. However, more needs to be done to address these concerns and ensure that online lending platforms operate fairly and transparently.